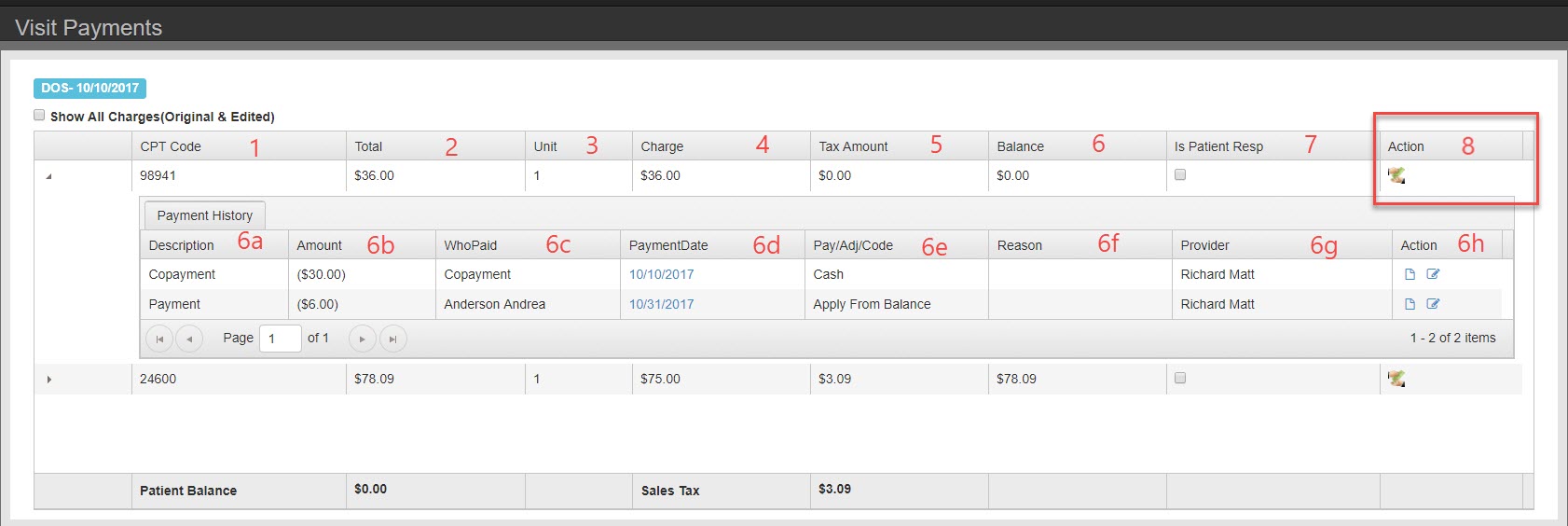

- The first column is procedures: CPT, Gcodes, or other office codes. Each individual procedure is presented in a single row. Payments and adjustments can be applied on a charge by charge basis.

- Total – charge x units

- Unit – number of units billed for the specific procedure

- Charge – cost per unit of service

- Tax amount – if the charge is taxable, the amount of tax calculated into the balance.

- Balance – Sum of Charge and Tax minus all payments listed in Payment History

- Description – Payment, Copay, or adjustment

- Amount – Amount applied

- WhoPaid – Payer or Guarantor. If co-payment tool was used it will say Co-payment

- Payment Date – date the payment was applied to the charge (not always the date payment was taken)

- Payment Adjustment Code – Further classification of payment or adjustment. Each selection available is based on the description. For payment guarantor you have options for check, chash, visa, master card, etc. For payment from payer you have options Ins Check, direct deposit, etc.

- Reason – Select reason for an adjustment for practice analysis reporting

- Provider – Provider the charge is associated with.

- Action: print a receipt or edit the payment record.

- Is Patient Responsible – check here if patient for the remainder of charges

- Add payment- Apply payment per line item. You can add a new payment or apply from credit balance.

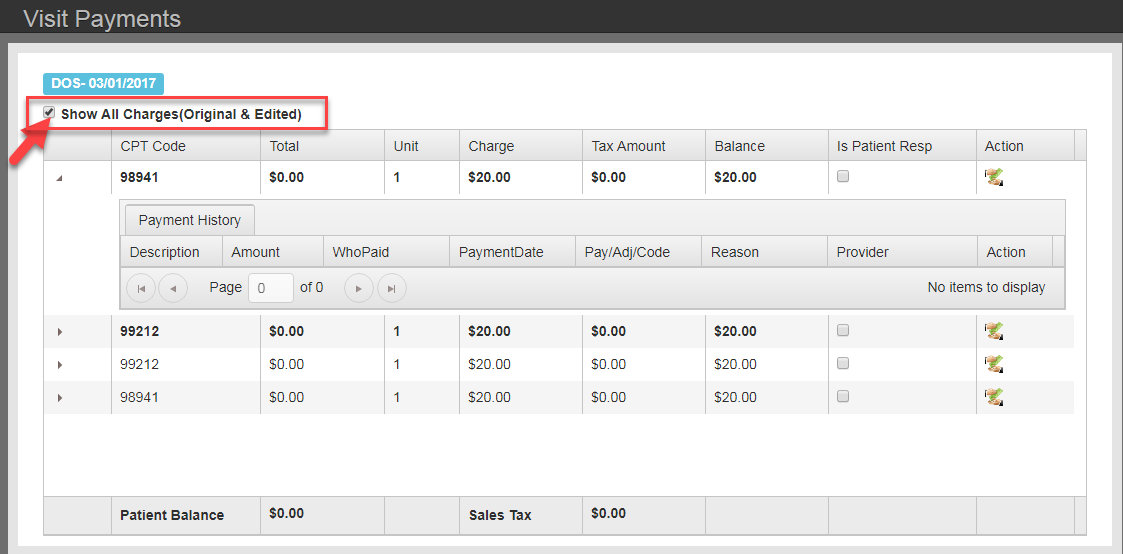

The edited charges are codes that were changed in billing when creating a corrected claim.

Anything that is bold is an edited charge.